21st Century Accounting Revision 4.1-8.8.01 Issues (Cumulative)

21st Century Accounting Version 8.8.01

This 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting.

Support for 2024 Pre-printed Forms

Support for Office Depot 2024 Form 1099-NEC

Support for Dynamic Systems Pre-printed 2024 Form 1099-NEC

Support for Blue Summit (Amazon) Pre-printed 2024 Form 1099-NEC

Support for Federal 1099-MISC and 1096, customize as required

Changes can be made to form 1099-NEC but should not be saved. Changes can be saved for the 1099-MISC.

21st Century Accounting Version 8.7.04

This 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting.

Support for 2023 Pre-printed Forms

Amazon Blue Summit 1099-MISC

Amazon Blue Summit 1099-NEC

Dynamic Systems

1099-MISC

Dynamic Systems 1099-NEC

Office Depot 1099-MISC

Office Depot 1099-NEC

Changes can be made to form 1099-NEC but should not be saved. Changes can be saved for the 1099-MISC.

Problems Fixed - The Receipts Journal was including all accounts instead of selected accounts even with that parmater selected. This problem has been fixed.

21st Century Accounting Version 8.6.17

This 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting.

1099-MISC and 1099-NEC - Due to customer requests, we have returned Box 7 as an option to select in Payables/Configure/Vendors "Report on 1099". If your Vendors were previously configured for Box 7, this upgrade will return the Vendor setup as it was. Please note that there is not an amount that acutally goes in Box 7 on the 1099-NEC or the 1099-MISC. If you have Box 7 entered it will go in Box 1 on the 1099-NEC.

Please note Deluxe Tax Forms are no longer supported.

NOTE: This upgrade contains some adjustments to the 1099-NEC layout for Pre-printed forms. If you worked with a technician or received an adjustment file from us, this upgrade will replace those files. If you would like to keep your forms as they are, copy the following files to a safe location from your C21/Reports folder:

ap1099necamazon.tcl

ap1099necdynamicsystems.tcl

ap1099necofficedepot.tcl

After installation is complete, return the files to the C21/Reports folder and replace the new files from this upgrade. If you require assistance, please let us know.

If you do not see the options for the various forms in the Payables/Print menu, please install your Tax Table.

21st Century Accounting Version 8.5.15

The 8.5.15 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting. Installing the Upgrade will bring your 21st Century Accounting to the 8.5.15 version level.

1099-MISC and 1099-NEC - Box 7 had been removed in Version 8.5.14 since it is no longer supported. Version 8.5.15 puts the box back so you do not need to update your Vendors if you are printing 1099-NECs as any Box selection puts the amount in Box 1 on the 1099-NEC.

21st Century Accounting Version 8.5.14

The 8.5.14 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting. Installing the Upgrade will bring your 21st Century Accounting to the 8.5.14 version level.

Support for 1099-MISC 2022 Forms

Changes to many of the 1099-MISC forms for 2022 require that the year 2022 be printed on the form. If the year is in the incorrect location on your form, activate the Report Customizer in the System menu. Then preview the form and use the red guidelines to move the year where you need it.

Please reply to this email if you require assistance with your form adjustments.

Support for 1099-NEC 2022 Forms

Select the appropriate form in the Payables/Print menu.

2022 Office Depot Forms

2022 Amazon Forms

2022 Dynamic Systems Forms

Please reply to this email if you require assistance with your form adjustments.

PLEASE NOTE: For 1099-NEC Forms, if adjustments are made, print the forms after adjustments are made. Saving your changes will require you to re-install this upgrade and you will lose your changes.

Receive Credit Card Payments - Additional fix for Receive Credit Card Payments module error.

Problems Fixed in 8.2.01

Receive Credit Card Payments - Additional fix for Receive Credit Card Payments module error.

Enhancements in 8.1.03

Direct Deposit - Some banks require a specific letter or number in front of the Immediate origin ID in the NACHA file for upload. A new box, 'Immediate origin ID prefix,' is now provided directly beneath the Immediate origin ID in Payroll/Configure/Company Information a specific digit or letter is required. If you leave the box blank, a '1' will be recorded in the prefix space.

1099-NEC - For tax year 2021, the IRS has redesigned Form 1099-NEC to three forms per page rather than two forms as in 2020. You will now see three sections for 1099-NEC recipients per form but you may need to make adjustments based on the pre-printed form you are using. Check System/Customize Reports and Forms and then Preview the form in Payables/Print/1099-NEC to make these adjustments before printing on your actual forms. Test the printout on blank paper against your pre-printed form to be sure that all data lines up correctly. You can make changes directly in the Preview form if necessary.

Receive Credit Card Payments - A bug existed in the Sales/Receive Credit Card Payments module that prevented discounts from posting to associated Discount GL accounts. This bug was not rectifiable so the Discounts option has been removed from the module.

Help - Additional Help items added.

Enhancements in 8.0.05

Payables/Configure/Vendors - The Box 7 option in the Report on 1099 selector in Configure/Vendors has been returned to the selector list. This has been put back for use on the 1099-NEC. If you had your vendors previously configured for Box 7 and have not changed them, installing this update will automatically assign the Box 7 option to their configuration. Any Box you select in Report on 1099s will assign the amount to Box 1 of the 1099-NEC.

2020 Form 1096 - Changes to the 1096 for 2020 include the addition of a box designated 1099-NEC (71) for Vendors that require the Form 1099-NEC. C21 does not support more than one box on the 1096, however, there is a workaround for the 1099-NEC Box on the 1096.

- Go to System and check 'Customize Reports and Forms.'

- In Payables/Print/1099 Payments, preview or print a report for the year to see which Box is checked for your Vendors.

- In Payables/Print/1096s, select the Vendors that required the 1099-NEC form (Box 7 with this update). Click Browse next to Selected Vendors and check any Vendors that required this form. See the 1099 Payments report if you are unsure.

- Click Preview.

- If you hover over the X that would normally go in the 1099-MISC Box, you will see blue lines appear that turn red when you click on them. Click the lines and drag the X over so that it will line up inside the 1099-NEC box on whatever preprinted form you are using. We recommend that you print it out on a blank piece of paper and line it up before printing on your form. When you close out of the Preview, if you do not save, the X will return to the original position.

Enhancements in 8.0.03

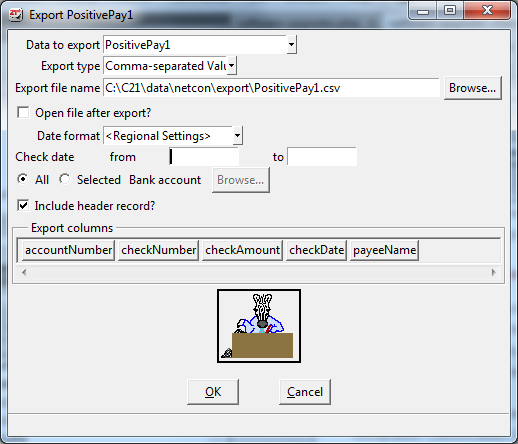

- In the 'Data to export' box, use the pull-down arrow to select either PositivePay1 or PositivePay10. Both of these exports include the Account Number, Check Number, Check Amount, Check Date, and Payee Name for any checks that have not been reconciled. The PositivePay10 export pads the account number to make 10 digits.

- Select the 'Export type', either CSV or Tabbed.

- The Export file name will be automatically filled in. If you wish to change this location, browse to the location of your choice.

- You must enter a Check Date range to produce the file and select either All or a specific bank account.

- Click OK to produce the file which can be found at the location indicated. If you wish to rearrange items in the CSV file, open the file in excel and rearrange the columns as needed.

1099-NEC - If you have vendors set up to be recorded on a 1099, you will also be able to produce the data for the 1099-NEC. Box 1 of the 1099-NEC is supported and will be filled in regardless of which 1099 Box you have elected in Payables/Configure/Vendors. To produce the data for Box 1 on your pre-ordered 1099-NEC form, go to Payables/Print/1099 NEC. If you need to adjust the placement of the Box 1 amount to suit your pre-ordered forms, check Customize Reports and Forms in the System menu. When you preview the form in 1099 NEC, you can move the blue lines to adjust the placement.

1099-MISC - Changes have been made to the 1099 - MISC. The following table shows how the changes correspond to Box selections for 2020.

| 2019 | 2020 | Name | Supported? |

|---|---|---|---|

| Box 1 | Box 1 | Rents | Yes |

| Box 2 | Box 2 | Royalties | Yes |

| Box 3 | Box 3 | Other Income | Yes |

| Box 4 | Box 4 | Federal income tax withheld | No |

| Box 5 | Box 5 | Fishing boat proceeds | Yes |

| Box 6 | Box 6 | Medical and health care payments | Yes |

| Box 7 | Nonemployee Compensation | See 1099-NEC | |

| Box 8 | Box 8 | Substitute payments in lieu... | No |

| Box 9 | Box 7 | Payer made directs sales of $5000 ... | No |

| Box 10 | Box 9 | Crop insurance proceeds | Yes |

| Box 11 | Box 11 | Blank | |

| Box 12 | Box 12 | Section 409A deferrals | Yes |

| Box 13 | Box 13 | Excess golden parachute payments... | Yes |

| Box 14 | No longer included in form | No | |

| Box 15a | Blank | Blank | |

| Box 15b | Box 14 | Nonqualified deferred compensation | Yes |

Positive Pay - You can now export a CSV file to accommodate Positive Pay banking requirements. To access these exports, go to System/Company/Export/Custom.

C21 Help - Added help for 2020 Federal Income Tax (FIT) changes.

Problems Fixed in Version 7.4.02

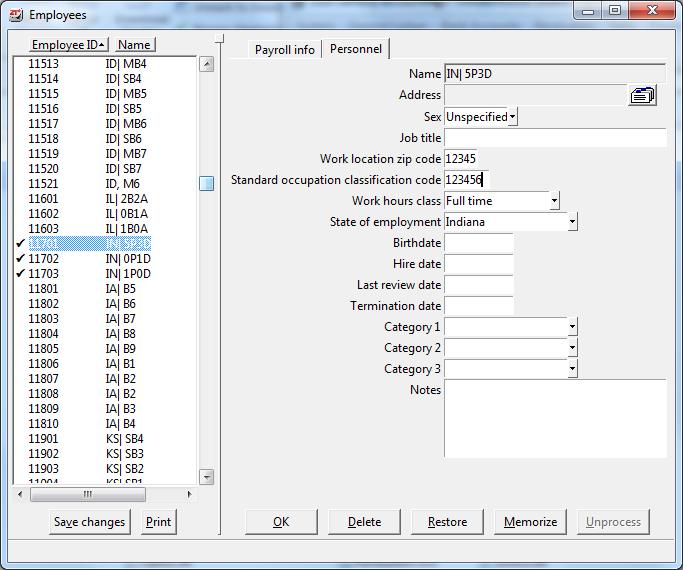

- Indiana Quarterly Wage Report (SUTA) Electronic Filing - Corrections made to the upload file for Indiana Quarterly Wage Reporting. You will need to reconfigure your Indiana Employees in Payroll/Configure/Employees. After reconfiguring your employees, you will be able to add the Work Location Zip Code and the Standard Occupation Classification Code in the Personnel tab of each employee that will be included in the report. This is required for all employees in the Indiana Quarterly Wage Report. You will then be able to produce the upload file in Payroll/Electronic Filing/Indiana Quarterly Wage Report. Please install the most recent Payroll Tax Update along with this upgrade.

- Calculate Payroll Income Factors - Calculate Payroll will now skip over Overtime Multiplier income factors when looking for an income rate to use for accruals pay out.

Problems Fixed in Version 7.3.00

- Bank Accounts/Deposits – In Bank Accounts/Deposits, when more than one item is listed in a batch, a duplicate error could occur while clicking through individual items in the batch. This error would have shown as a modified record with a check mark next to the item name. This error has been corrected.

Enhancements in Version 7.2.00

- Check for duplicate Social Security Numbers revised– When you configure employees in Payroll/Configure Employees, the system will check for duplicate Social Security Numbers but will only display a warning message informing you of this duplication. You will be able to click OK and continue on with the duplicated number. This change has been made so that employees who are listed more than once will not require "dummy" Social Security Numbers.

- Indiana SUTA Electronic Filing - Due to the changes Indiana has made to their SUTA reporting, you can now upload your Quarterly Wage Report by going to Payroll/Electronic Reporting/Indiana Quarterly Wage Report. You will also need to have Payroll Tax Update 4/17/2019 installed.

Problems Fixed in Version 7.2.00

- Accrual Report - The Payroll/Accural Balances Report was not calculating correctly when amounts were carried over from previous years. This has been fixed.

- Accrual Balance in Calculate Payroll - An error message was produced when entering a value in Calculate Payroll/Accrual Balances. This has been fixed.

- Workers' Comp Code Error - When changing a Workers' Comp Code to an a code that has already been in use in the same date range with, an error occurs. This has been fixed.

Enhancements in Version 7.0.04

- Check for duplicate Social Security Numbers – When you configure employees in Payroll/Configure Employees, the system will check for duplicate Social Security Numbers to ensure that you have not inadvertently entered a duplicate number. A message will alert you to a duplication and you will not be able to save your changes unless you enter a Social Security number that has not been entered for another employee, even if it is for the same employee.

- Check for duplicate Bank Account Numbers – For Direct Deposit users, when you configure employees in Payroll/Configure Employees, the system will check for duplicate Bank Account Numbers with the same Bank ABA Number to ensure that you have not inadvertently entered a duplicate Bank Account Number. A message will alert you to a duplication.

Enhancements in Version 6.9.04

- Invoice Notes – You can now enter notes for individual batches in Sales/Invoices by right-clicking on an open batch and selecting Show Batch Notes. Anything you enter will automatically be saved and can be re-opened and edited.

- Deposits – You can now move individual deposits from one open batch to another in Bank Accounts/Deposits.

- Payroll - You can now change a posted Payroll Workers' Comp. Code to a different Workers' Comp. code using the new menu item in Payroll/Change Posted Workers' Comp. Code

Problems Fixed in Version 6.9.04

- Problem with Payables default control account specification in company configuration file on Payables/Vendor Invoice batch listing. This has been fixed.

- Problem with displayed accrual balances in Calculate Payroll when payroll setup changes. This has been fixed.

Enhancements in Version 6.8.10

- C21 Subscription Status – When you log onto C21 on a computer with internet access, if your subscription is due for renewal or will soon expire, a message will open letting you know. Otherwise, no message will appear and the program will start as expected.

- Pay Factors on Pay Stub – Pay factors will print on a pay stub when the current pay period hours are non-zero even if the amount is zero.

- Notes on a Pay Stub - Insert a note on any check stub -- AP, CD, or PR. Click here for instructions.

Problems Fixed in Version 6.8.10

- Error in command lines for backup/restore has been corrected.

- System allowed a payroll check to be voided on the wrong date. This has been corrected. If the year and month of current pay period has already been established, then the void date of the check must match that year/month or you will need to create a new pay period that matches the void date.

- Bank Rec: Statement end dates whose related period are not defined in financial calendar caused problems. This has been fixed.

Version 6.7.06

Problems fixed in Version 6.7.06

- If you encounter issues with 6.7.05, please install this upgrade to roll back the changes on 6.7.05. We are working on a new release with the enhancements and problems fixed on the upgrade. We will announce it's release as soon as possible. Thank you for your patience!

Version 6.7.05 - DELAYED

Enhancements in Version 6.7.05

- Subscription Renewal Alert – When you log onto C21, if your Subscription is due for renewal or will soon expire, a message will appear letting you know.

Problems Fixed in Version 6.7.05

- Command lines for backup/restore where path to exe had embedded space would produce an error message. This has been corrected.

- Bank Reconciliation : Statement end dates whose related period were not defined in the financial calendar could lead to issues. This has been fixed.

Version 6.6.05

Enhancements in Version 6.6.05

- Void Receipts – When you enter a document number, the program will now try to find a match regardless of the case.

- Payroll Deductions – Added ability to set up and calculate an employer match of employee contribution up to some maximum percent or amount.

- Submit Problem Report - Problem Report command now has clearer labels on fields.

- Bank Accounts - Credit Card Register now shows the Card Number and amount entered in the following situations: Payment Tendered Description field for Credit Card Payment types entered on Sales Invoices and Card Number entered in Sales/Receive Credit Card Payments.

Problems Fixed in Version 6.6.05

- When Sending Company Data to 21st Century Accounting, the program can send a backup which is incomplete because of "in use" files. This has been corrected.

- Trying to delete user-defined "in use" items can cause a special entity record to be deleted which can cause problems in reports. This has been corrected.

- On the Payroll Employee "Pay Configuration" and "Complete Information" report the information for employees with the exact same name is repeated several times. This has been corrected.

- Sales Invoices - In some cases the email function could become disabled when you edit the Shipping address. This has been corrected.

- Bank Accounts - Deposits Journal always showed a Report Total of zero dollars for "Transaction date" and "Deposit number" sort orders. This has been corrected.

- California DE9C - Change Electronic Filing, California DE9C to match state requirements as of Q1/2017. (Previously released January 20, 2017)

- The Payable Vendor Invoice command encountered an error when printing a batch listing of invoice that had a payment by EFT. This has been corrected.

- Company Names - There were some places in the program that accepted invalid characters which generally led to problems. This has been corrected.

- Some computer systems are configured to not use internal shortnames. This could cause problems in some Company Restore situations. This has been corrected.

Enhancements in Version 6.5.07

- Improved Credit Card Management – Easily record credit card payments that are received after a sales invoice has been posted. Go to Sales/Receive Credit Card Payments. You can still record credit card payments at time of sale in Sales/Invoices.

- Batch Management –

- Find items in Saved and Recurring Batches - To find an invoice for a customer in Saved (not yet posted) and recurring invoices, click inside the Batch pane and click F3. Enter the name or serial number of the customer you wish to find. The batch that contains the customer you are looking for will open and their invoice will be high-lighted.

- Sort entries in a batch - To sort the entries of a saved or recurring batch, right-click on the batch name, then select Sort batch entries. This will put the entries in order alphabetically by customer name.

- Find items in Saved and Recurring Batches - To find an invoice for a customer in Saved (not yet posted) and recurring invoices, click inside the Batch pane and click F3. Enter the name or serial number of the customer you wish to find. The batch that contains the customer you are looking for will open and their invoice will be high-lighted.

- Bank Rec - Clear all checked off items - In Bank Accounts/Reconciliation, you can “un-check” all the items in Withdrawals and/or deposits. Click the new button, ‘Unmark All,’ in the Cleared/Outstanding section of the screen.

- Payroll - Email Direct Deposit pay advices to Employees - Emailing will automatically occur when you select ‘Print’ in Payroll/Print/Direct Deposit Paychecks otherwise the advice will be printed. When reprinting you will be able to email or print the advice as desired. Click here for details.

- Payroll - Flexible Accrual Ceiling - You now have the option to resume accruals hours if accrual hours are used after the ceiling was reached. When you process an accrual as you process payroll, if some accrual was used, the accrual will start accruing again until the ceiling is reached.

Otherwise when you process an accrual as you process payroll, if the unused accrual plus the current pay period accrual is greater than the ceiling, the current pay period accrual is limited by the ceiling. Any accrual used is not taken into account.

Go to Payroll/Configure/Vacation and Sick Accruals and check the box Flexible Accrual Ceiling.

- Payroll - Wage garnishment

- Support for Annual and Gross Ceilings- Wage garnishment tables now support annual ceiling and gross ceiling. Gross Ceiling refers to the total amount that can be deducted over all the years that the garnishment is available. Select Wage Garnishment Table in Payroll/Configure/Deductions to set up these new fields in existing Wage Garnishments.

- A new wage garnishment choice - Wage Garnishment:Table:Employee Limits, permits the setting of these ceilings at the Employee level.

- Payroll - Paycheck advice rate of pay - In certain circumstances the rate of pay doesn’t show on the paycheck advice. This had to do with a change in how decimal values are processed in the latest version of the database used by Payroll - Actian PSQL v12. This has been corrected.

Enhancements in Version 6.4.03

- Move a Sales Invoice to another batch – You can now ‘drag’ a sales invoice to another batch. This is useful when, for example, you want to close a batch but one invoice needs to be held open. In the left pane, left click on the invoice and drag it to the desired batch. You can move entries within recurring batches or regular batches, but not between these types of batches. If an invoice is moved to a batch with a different GL period, the moved invoice will be assigned that GL period. The date will remain the same (a warning message will displayed). The date can be changed if appropriate.

- Control the timing of emailing invoices – In Sales Invoices, the email button has new choices. You can choose to email immediately, email at posting or not email. Choose ‘email now’ to email the invoice immediately. Choose ‘email at posting’ to mark this invoice to be emailed when the batch is posted. Choose ‘do not email’ to remove an email that was previously marked to be sent at posting.

In conjunction with the new ability to move an invoice to a different batch, you now have better control over emailing invoices. By using the option to email at posting, you can delay sending invoices until you are ready to send them all. If you need to hold back one or two invoices for review, those invoices can now be moved to a new batch.

- Show customer’s email address on invoices- You can now display a customer email address on the customer’s invoice, at the location of your choice. You elect to show email addresses on invoices by a specification that you make using the report customizer. Click here for more information.

- Prevent mistakes when voiding - When voiding checks or receipts, the system will now provide a warning if the GL period and transaction date are not the same as the original check or receipt. The system now defaults to the Period/Date of the original check/receipt. The Period and Date can be changed, if appropriate. A warning will be displayed in this case but can be bypassed. You can also now void checks and receipts in different periods in the same batch.

-

Recurring Invoices - Recurring Invoices will now be automatically updated when changes are made to the item list. When you revise your item list and Save changes, you will be prompted to update your recurring entries with the changes. If you select Yes, your recurring invoices will automatically be updated with any changes you have made to Price field, Taxable flag or Discountable flag. Click here for more information.

- Sales Taxes - When invoicing, the system will now display the sales tax group assigned to the customer (if one has been assigned). The system used to display the tax group from the previous entry in the invoice batch. That is now an option. If you wish for the system to display the tax group of the previous invoice in the batch (for example you don’t have sales taxes set up in customers’ configurations), then you must elect that choice. Go to System/User IDs and check the box Remember sales tax groups.

- Improvement to financial reports when more than four levels- Financial Reports using customized templates with more than four levels did not display correctly. This has been corrected.

Problems fixed in Version 6.3.01

-

In some cases, customized reports do not print under 6.3.0, showing the error message “unable to load report”. This problem has been fixed.

Enhancements in Version 6.3.00

- Payables Vendor Invoice Journal did not show accurate totals in certain cases with voided invoices. That has been corrected.

- Vendor Invoices – If a payment is entered which causes a negative balance due on the invoice, you will now receive a warning message.

- Bank Reconciliation – In some cases, zero dollar checks did not display correctly in bank reconciliation. That has been corrected.

- Receivables Statements – You can now email customer statements with a custom logo.

- New! Reprint W-2 for Prior Year – You can now reprint W-2s going back to the year 2013. Go to Payroll/Print/Reprint Prior Year W-2.

Problems fixed in 6.2.00

-

Prevent extraneous error messages which prevented selecting companies for some installations.

Enhancements in Version 6.1.03

- Support for environment changes - There have been several important ‘under the covers’ changes which will make it easier if you make changes to your environment such as:

- Moving to a new computer

- Adding a computer to your network

- Reinstalling C21

- Changing your database

- Bank Accounts\Deposits- Modified to improve reliability in multi-user environments.

- Bank Reconciliation – In a multi-user environment, a second C21 user can now review the bank reconciliation for the same bank account without closing C21 first.

- Bank Reconciliation – You can now sort by dollar amount in bank reconciliation. Click on the Amount column heading to sort by amount, just as you already do to sort by check number or date. Sorting by amount can be helpful when working with a large number of electronic transactions.

- Support for latest database version – This version of C21 is required if you upgrade to the latest version of the Actian/Pervasive database used by C21, PSQL v12.

- Payroll - Hours of Service Report – a major fix – The hours of service report did not include accrual hours paid in the report. This has been corrected.

- Payroll Print Employee – You asked, we answered! The following capabilities have been restored:

- You can now view the department percentage allocations in Print/Employee/Pay Configuration.

- Employee Complete information option has been restored. Go to Print/Employee/Complete Information.

- Terminated employees now print on all variations of this report when the ‘All employees’ option is requested.

Problems Fixed in Version 5.5.09

- Restore access to Direct Deposit for those who previously

had it installed

Enhancements in Version 5.5.08

General

You must be using Pervasive PSQL database version 10 or greater for this update –If the Pervasive PSQL database engine on your computer is older than version 10, you will not be able to install this update. Certain new features in this release utilize features only available in the latest versions of the database software. Click here to learn how to find your database version.

Payroll

- Hours of Service Report: This new report can be used to determine...

- employee eligibility for insurance offering;

- if the employer is a “large” employer and therefore subject to ACA regulations;

- the number of full time and full time equivalent employees;

- whether employees should be classified as full time or part time for the various measurement periods as required by ACA (shows hours worked per calendar month using the ‘weekly rule’ for weekly and biweekly employees);

- Expanded employee classifications The choice box for ‘part time’ in Configure Employees has changed to a selector list with expanded employee classifications that are needed for Affordable Care Act (ACA) compliance. The classifications supported are Full Time, Part Time, Variable, Seasonal and Other. The first time that a company is selected, employees who are currently set as ‘Part time’ will retain that status. Other employees will be defaulted to ‘Full time’. Go to Configure Employees/Personnel tab and see ‘Work hours class’. The Audit Report will show changes to employee classifications.

- Calculate Payroll and Employee Adjustments Payroll start and end dates are now required for both of these commands. This information is needed for the monthly reporting in the Hours of Service report.

Support for Affordable Care Act:

The report can be part of the audit trail needed to prove compliance with ACA regulations.

Click here for additional information.

Employee Information Report

The employee information report has been rewritten to allow more flexibility. You select the information to be shown. It has been divided into two reports, one with pay information and one with personnel information. The personnel information report allows you to select up to six items to view at one time. Go to Payroll/Print/Employee.Custom Pay Summary:

- New Data Types in Configure - Employees' Street, City, and State are now supported as separate Data Types selections which can be added as columns to your reports. A new Constant Data Type permits you to specify a value which will be included in every record. This is useful for exporting to a predefined file or excel structure. Constant fields can be ‘blank’ fields. Go to Payroll/Configure/Custom Pay Summary, click on Add Column to use the new Data Types options.

- New Print selection option - For departmentalized payrolls, you can now choose all or selected departments when printing or exporting.

- Enhanced Export - You can now export to a comma separated value (CSV format) in addition to the currently supported tabbed delimited field file (TXT format). In addition, the new dialog box has options to include a header record and the sort fields in the exported file. Do not include sort fields if you want the exported file to contain only the fields defined for the report, without the sort values prefixed to the beginning of each line. In Payroll/Print/Custom Pay Summary click on the Export button.

Override hourly pay rate during timecard entry –You can now override hourly pay rates during timecard entry. You can also specify multiple rates for the same income factor. In Payroll/Configure/Company Information, there is now an option to “Allow hourly rate override on timecards”. Check this field if you wish to override hourly pay rates during timecard entry. The hourly rate field will display on the timecard screen and can be modified. Click here for more details.

Flexible Accrual Rollover –Until now, if you did not wish to carry over employee accrual balances into the new year, you had to adjust each employee’s accrual balance at the start of the year. With this update, you can now choose whether accrual balances roll over or are set to zero for a new year. If you wish for employees’ accrual balances to re-set to zero at the turn of the year, uncheck the flag “Carry over accrual balances” in Payroll/Configure/Company Information.

Reprint Paychecks–The YTD amounts displayed on reprinted paychecks were not always correct in cases where payroll information had been inserted into prior period(s). This has been corrected. Reprinting paychecks is a feature of direct deposit.

Changes in Version 5.3.06

General System Improvements – There are some important under the cover changes, particularly for networked 21st Century installations managing multiple companies.

Undo a Bank Reconciliation – You can select “Undo Bank Reconciliation” under Bank Accounts/Void to go back to the most recently closed Bank Reconciliation. This procedure does not reverse adjustments made in Bank Rec, that is, items entered on the Adjustments tab in Bank Rec. After you undo a bank rec, those adjustments will appear in the Withdrawals and Deposits tabs as journal entries. You clear those journal entries in place of adding transactions in Adjustments when you redo the bank rec. If adjustment reversals are desired, they will need to be performed in General Journal.

Payroll Register – Employer side activity now shows on the Payroll Register when that option is checked in the Payroll Register Print window. You will now be able to verify the employer side before posting.

Sales Orders –When converting a Sales Order to an invoice for an Occasional Customer, the customer name from the sales order will now appear on the invoice in the case where the name field has not been filled in.

Zero value checks – Zero value checks will no longer be posted as voided. You will now be able to void the check if needed.

Custom Pay Summary Report – The ability to add Employee Sex designation to Custom Pay Summary Reports has been added.

After-the-fact Paychecks – You can now start a new pay period with a Year or Year/Month that precedes that of the latest processed pay period Year/Month. Or, if no other checks have been posted in the current pay period, you can specify a check date whose Year and Month precede that of the latest processed pay period Year/Month. As long as the Year/Month and/or date does not fall within a quarter which has been closed using Payroll/Quarterly Checklist, you can now post to a Year/Month which precedes that of the latest processed pay period.

Changes in Version 5.2.01

Financial Report Templates/Caption/Column Options – When a caption definition contains an inner caption definition, some column options for the first caption, such as "Include accounts in ratio", may not work properly. This can be corrected by re-saving the template definition after installing this update.

Departmentalized Payroll – For Payroll companies configured for "Departmentalization by G/L account segment”, changing an employee's Department assignment(s) in Configure/Employees did not work properly. This has been corrected.

Historical Balances – In General Ledger/Configure/Historical Balances, in some rare situations, even though all the account balances for a period produce the correct Balance sheet, Net Income (Loss) and Trial balance totals, the program erroneously displayed a "total must be zero" error when trying to save the period information. This has been corrected.

Workstation computers –which access the 21st Century Accounting program using a UNC share name which contains spaces (for example //myserver/S Drive/C21) may encounter an error such as "Error: can't find package mkZiplib". This has been corrected.

Changes in Version 5.1.04

GL Activity Report- In some cases in Version 5.0, on the GL Activity Report, periods with no activity were not showing when selected to show. Historically, this report showed a line item for each period in the reporting interval. This convention has been restored.

PDF Invoices for Emailing - Invoices in PDF format for emailing did not always have proper alignment. Occasionally, lines on the PDF invoices appeared to overlap. This has been corrected.

Reviewing Batches during Data Entry - During data entry, when viewing a batch, the "Review Batch" popup command gets an error. This has been corrected.

Changes in Version 5.0.07

Version 5.0.07 has a change which affects ONLY the installation of the 21st Century Accounting Upgrade. If you have already installed the disk that was recently sent to you (5.0.06), please DO NOT install this upgrade You can verify your current installation by going to Help/About on the C21 menu.

Installation in a network environment –Corrects issue where, when installing the upgrade, 21st Century Accounting did not always detect if C21 was running on another computer.

Changes in Version 5.0.06

-

Email invoices and statements – You can create a PDF version of an invoice or statement that can be emailed as an attachment. Click here for details.

-

Email reports – Many reports can now be easily emailed by exporting to a PDF file and then clicking an email option. Click here for details.

-

Email Direct Deposit Advices – If you have PrintBoss (from Wellspring Software) installed, PrintBoss can be configured to email direct deposit advices as PDF attachments. C21 now supports this feature. Go to Hot Topics for details.

-

Electronic Funds Transfer –You can now track payments that you have made using Electronic Fund Transfer (EFT). EFT transactions are maintained in C21 in a manner similar to checks. You set up the starting EFT number in Bank Configuration. C21 maintains the EFT number as you enter EFT transactions, the same as check numbers. EFTs are displayed with the prefix ‘EFT’, for example EFT4708. Click here for details.

-

Send feedback – To send us feedback, or make suggestions for improvement, click on Contact Us on the website and choose ‘Customer Service’. Your message will be forwarded to the appropriate area. You no longer send feedback directly from C21.

-

User defined taxes – In Payroll/Configure/Tax Calculations, there is a new "Earnings calculation" type that supports two exemption count dependent reductions to taxable wages. This accommodates Indiana county taxes.

-

Receivables/Print/Invoice List – In certain situations, some fields on the Invoice List report would not print. This has been corrected.

-

Delete Category value – If an unused Category value for Customers, Employees, or Vendors was deleted, the program stopped responding. This has been corrected.

-

Timecard Entry – If a company is configured for Payroll Departmentalization by G/L segment value, and if a timecard detail line is entered with negative hours, then in some situations a posting failure could occur. This has been corrected.

New for 5.0

Changes in 5.0

Changes in Version 4.6.01

- Select Company – When selecting a company, you may see a message saying “Your computer configuration settings indicate that you could experience problems…”. We recommend that you run the update, it will fix a Windows problem that occurs in certain network environments. The program has determined that the computer which displays this message has the characteristics that make this problem occur. Note: running this update will prevent you from erroneously getting the message “No data for this report to print” when running certain reports from this computer.

- Bank Reconciliation – In some situations the program may inappropriately display the message "Error: another user is currently reconciling this bank account" and prevent access to the reconciliation. This has been corrected.

- Company Preferences Error Message - Getting error message "Error: Invalid Form 'prddchk.tcl” when exiting from Company Preferences. This has been corrected.

Payroll

- After the Fact Payroll – When entering information in After the Fact, upon clicking "Post" you may receive the error message "Program error: can't read "DED_WAGEGARN_TABLE": no such variable ". This has been corrected.

- Manual Pay Distribution –If you use manual pay distribution and your payroll is departmentalized ‘by category’, you may have this problem. (You can see your departmentalization choice by going to Payroll/Configure/Company Information.) When you click “Done” or “Finish later”, you may receive the error message: “Program error: can't read "entry(c,manPay_deptDistribution,0,departmentRef)": no such element in array. If you encounter this error message, then you should install this disk. Then go back to Calculate Payroll. You will need to re-enter hours and manual pay information for those employees, that weren’t saved.

- Print Direct Deposit Paychecks – When printing paycheck stubs for direct deposit employees, you may see the error message “Error batches Checks: 20120604:000 1 of 1 entries did not posit, 1 did not verify”. This has been corrected.

- Payables Checks, Disbursement Checks, Paychecks - Occasionally, unwanted special characters printed on checks. This has been corrected.

Changes in Version 4.5.07

- Find Function - The Find function key has been improved to use fewer keystrokes for searching long lists of Vendors, Customers, Employees, GL Accounts and more. Click F3 in the left “pane” to quickly find Vendors, Customers, Employees, etc. Try it in any “Configure” screen which has a left pane as well as in Configure/Chart of Accounts. You can also use it in Bank Reconciliation on the Deposits and Withdrawals tabs.

- 64-bit Computers – A number of “under the cover” changes have been made to accommodate 64-bit environments, which have become the norm for new computers.

- GL Account Segment Names – You can now delete GL Account Segment Names. See General Ledger/Configure/GL Account Segment Names for.

- General Ledger Activity has Improved information for Custom Journals and Cash Receipts Journals – The journal name shows in the “Comment” column of the General Ledger Activity report whenever \ no specific prompt description has been defined.

- Historical Balances (GL) – Co-ordination for updating fields has been improved in the situation of editing multiple periods in the same session.

- General Journal – In the General Journal batch listing, the entry number sequence in Recurring Batches is now correct at all times.

- Company Backup – In certain environments, when performing a backup on the currently selected company, the backup will fail with the error ~pvsw~.loc file not found. This has been corrected.

- Import Sales Invoices – The import for Sales/Invoices now sets pre-pay discount amounts correctly.

- Financial Reports – In companies configured with multi-segment GL Account structure without a separator character, when printing a financial report specifying “Single” information for one of the segments, the report includes accounts with segment values besides the one selected. This has been corrected.

- Bank Reconciliation -

- An unlimited number of bank reconciliations is now permitted. There had been a limit of 999 reconciliation batches and one would get the message “Unable to create new batch”.

- Posting - Reconciliation will now post items with a document number of “0” (zero).

- Company Recreate - With Pervasive database version 10.0 or higher, company recreate would fail with error syntax error in expression 0 : unexpected operator . This has been corrected.

- User defined names with commas - When user defined names, such as GL department segment names, are defined with embedded commas, selection list windows which include these names will now display properly.

Payroll

- Vacations and Sick Accruals - A new report has been added that shows the hours accrued for vacation, sick or others that you have configured. See Payroll/Print/Accrual Balances.

- Manual Pay Distributions - For companies with departmentalization by GL account segment, with manual pay distribution enabled: you can now automatically distribute some earnings based on employee configurations and separately distribute other earnings manually. Previously, if any pay was being manually distributed, then all earnings were distributed according to the same departmental ratios.

- New Employee Contribution Methods for Deductions

- Percent of Earnings: Employee Limits – same as “Percent of earnings” but supports employee specific Period, Annual, and Gross Ceilings as well as percentage.

- Amount per pay period: Employee Limits – same as “Amount per pay period” but supports employee specific Annual and Gross Ceilings as well as amount.

- Wage Garnishment: PercentageWage garnishment support, including “Disposable pay includes” definition, based on a single percentage and supports employee specific Period, Annual, and Gross ceilings as well as percentage.

- Custom Pay Summary-

- New fields supported- Support for displaying an employee’s Last Review Date and Pay Rate has been added.

- Deleted Pay Factors - Certain actions, such as renaming or deleting a pay factor, can cause problems with Custom Pay Summary reports that reference the factor, leading to the following warning message: Unknown payroll factor 'Mile' referenced in column definition. This has been corrected.

- Payroll Departments- When specifying departmentalization by GL account segment, the program will now accept zero as the default department value.

- Employer Deductions - You may now define an Employer deduction of type “Percent of (employee’s) contribution” with a value greater than 100%.

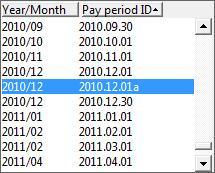

- Reports pay period id - The selection list of pay period IDs, used in various payroll reports, can be sorted by ‘Year/Month’. There is effectively a secondary sort on Pay Period ID which didn’t always sort in chronological order, depending on IDs used. The effect was that sometimes the actual last period processed didn’t appear in a report. Sorting on Year/Month now sorts in chronological order, regardless of the naming convention used in the Pay Period ID column.

- Employee Adjustments- If a company is configured for Departmentalization by GL account segment, then adjustments only requires a department designation when applicable – i.e. when the pay factor is configured to post to employee departments.

- Earnings Reports - In certain environments involving 64-bit computers, running this command results in a “No data for this report” message, when in fact relevant data does exist. This has been corrected.

- Timecards -

- Percent Hours Worked -Entries for “Percent hours worked” type accrual factors are not processed correctly. The program misinterprets the meaning of the Hrs/Pcs value. The program now correctly processes these timecard entries as number of hours being paid.

- Payroll/Departmentalization by category - If a company was configured for Payroll departmentalization 'by category' and, in Timecards, the “Initialize new timecards with employee incomes” was not checked, then one would see the error Error: lines,0,departmentID is required. This has been corrected.

- Direct Deposit -

- You can now specify the location for the Direct Deposit output file.

- You can new rebuild a Direct Deposit bank file for a specific bank account and check date. See Payroll/Print/Rebuild Direct Deposit file.

- You can now customize the advice layout and specify the desired layout for each company. See Company/Preferences.

- You can now use a 7 inch form for the Direct Deposit advice.

- Piece rates will now show on the Direct Deposit advice.

Problems Fixed in Version 4.4.01

After installing this Program Upgrade and the January 5, 2011 (or later) Tax Update, the Social Security withholding amounts for lines 5a and 5b will be correct for 2010 and 2011 941 processing.

At this time the IRS has not made the 941 form for 2011 available. The 941 Information command will continue to use the 2010 form layout and text for 2011 quarter processing until the official 2011 form is made available.

Enhancements in Version 4.3.0

- Payroll Transaction Details. Export parameter is a range of pay periods.

Problems Fixed in Version 4.3.0

Problems Fixed in Version 4.2.08

- System/User IDs. Attempts to delete User IDs produced errors. This problem has been corrected.

- Receivables/Customer Status. The drill down function in Receivables/Customer Status was unacceptably slow. This problem has been corrected.

- Import Timecards. The system allowed you to import timecards that included pay factors that were not configured for the employee. This problem has been corrected.

- System/Company/Verify/Recover posted invoice information. The Verify/Recover utility produced an error message when it sometimes tried to repost information because it failed to recognize that a posted invoice had been previously processed. This problem has been corrected.

- System/Company/Verify/Verify A/P Summary Information. This Verify step erroneously deemed voided cash disbursements checks to vendors as a problem and "repaired" them whenever you ran the utility. This problem has been corrected.

Problems Fixed in Version 4.2.05

- System startup or company selection. A warning message resulted if the Pervasive database engine was not running at the source of the software and company location. This message ("Pervasive not installed or functioning") failed to provide customers with sufficient information. The message has been modified for clarity and a full explanation with diagnostics for different environments is now provided online.

- User login. A security issue was fixed in an earlier version by enforcing the rule that prevents any User ID from being logged in at more than one workstation at a time. The resulting new error message caused some users to believe that only one person could log in at a time. An online "Hot Topic" is now provided to explain that each person in the office who works on 21st Century Accounting now simply needs a separate User ID.

- Sales/Invoices. The problem with long Purchase Order numbers has been corrected.

- Sales/Invoices. Numbers for new invoices sometimes defaulted to existing unposted invoice numbers. This problem has been corrected.

- System/Company/Backup. The problems some users had backing up to CDs using the Windows CD Writing Wizard have been corrected. You can now use the Wizard with the System/Company Backup function.

- System/Company/Backup. The backup function did not allow you to change the name of the backup file. This has been corrected so you can now modify the filename (as well as select the backup folder and append the date to the filename).

- Receivables/Print/Customer Activity by Period. The integrity warning message comparing customer transaction account balances with G/L control account balances displayed incorrect results. This problem has been corrected.

- System/Company/Backup and System/Company/Restore. The Backup and Restore functions have been separated on the menu and retooled to be more robust and smarter. They now display the progress of the Backup and Restore operations for your review. If a problem occurs that affects the integrity of the data, the operation stops. You can use the information in the Progress box as a troubleshooting tool.

- Sales/Print/Backorder Report. Backordered items are the items remaining on a Sales Order when a customer's order (for 42 widgets, say, entered on a Sales Order) is only partially filled (only 22 widgets in stock, say, sold via a Sales Invoice). The 20 widgets remaining on the SO are now considered on backorder. The number of backordered items is reduced as you invoice additional sales of the items and when you delete unfulfilled Sales Orders for those items.

The new Backorder Report on the Sales/Print menu shows the order date, item ID, order number, customer, quantity on backorder, UOM, unit price, and total price for each item listed.

- System/Company/Company Access Control. The new Company Access Control function lets you manage access to the selected company. The settings you make with this command are for a single company; they do not apply to any other companies.

- System/Access Control is unchanged. It resides on the menu in the same place as always and lets you set user access across companies as before.

- Payroll/Configure/Global Employee Update. You can now add, modify, and delete pay factors for all employees or for selected employees. Add and Modify display the selected factor's configurable attributes for completion. Delete displays no attributes. When you "post" the action, the system executes the selected action on the selected factor for the selected employees.

Enhancements in Version 4.1

Problems Fixed in Version 4.1

- Deleted Accounts. Deleted customers, vendors, and general ledger accounts could be used in transactions if the user typed the name of the account in the name field. This has been corrected. Deleted accounts can't be seen, selected, or typed in for transactions. They can be seen only in their configuration windows.

- Payroll/Configure/Employees. In companies with G/L departmentalization, when you edited and saved changes for multiple employees in the same Configure/Employees session, the program applied the first employee's department assignment to the employees beyond the first one edited, regardless of whether or not department edits were done. This has been corrected.

- Payroll/Print/W-3. The error message displayed if you tried to print the W-3 before printing W-2s was misleadingly alarming. The error message has been changed to a simple reminder to print W-2s first.

- Payroll/Print/Payroll Register.

- The Payroll Register's calculation of overtime based on an overtime multiplier has been made more robust. The overtime rate and pay amount will now be calculated correctly in all situations.

- The Payroll Register now prints correctly for companies that are departmentalized by Category.

- The Payroll Register company total for "Gross income" was sometimes incorrect. The report failed to add the employee gross income amount for reversing entries to the company totals. This has been corrected.

- Payroll/Print/Taxes Activity. The Taxes Activity report now prints correct totals when printed from Preview mode.

- Payroll/Configure/Custom Pay Summary and Payroll/Print/Custom Pay Summary.

- Payroll/Print/Custom Pay Summary now produces month-to-date totals based on the month associated with the ending pay period ID specified rather than the sum for all records of the relevant month, regardless of what year.

- Payroll/Print/Custom Pay Summary now prints columns that contain parentheses correctly.

- Payroll/Print/Custom Pay Summary no longer displays an error message when you select "All exp. reimbursements" as the "Factors to include."

- Generic Import Timecards. The generic Import Timecards program has been updated. It is now compatible with the current version of Payroll.

- Payroll/Void Checks. The specific issue that caused 21st Century Accounting to close abruptly when you attempted to void a check has been resolved. You can now void a check successfully without encountering an "Access Violation" crash.

- Payroll/Calculate Payroll. In certain situations,when you clicked "Done" or "Finish Later," Calculate Payroll would fail to post some of the data you entered in the Calculate window, such as hours worked or amounts paid out. The system assumed that it posted successfully and discarded the new data, so clicking "Done" again appeared to be successful also, but was just saving old data or zeroes.

This situation has been remedied. The Calculate Payroll buttons now behave as expected and the appropriate data is posted.

- Payroll/Calculate Payroll/Manual Pay Distribution. Prorated departmental distributions, based on manual pay distributions in a company that is departmentalized by G/L segments, did not always add up to 100%. Also, the handling of precision on the manual pay percentages was inconsistent.

These calculation issues have been resolved. The departmental distributions are calculated correctly and consistently.

- Payroll/Electronic Filing/NACHA Prenote File for Direct Deposit. The NACHA Prenote procedure now correctly calculates the check digit that will verify the Payroll bank account number in the NACHA DD file control record.