Oregon Paid Family Leave

Effective January 1, 2023

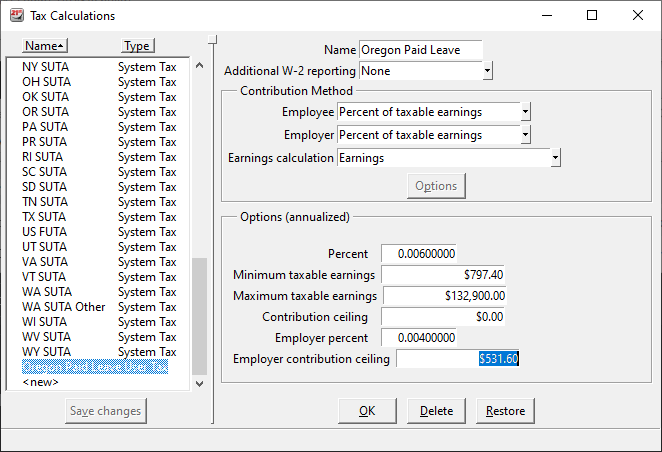

The Oregon contribution rate for 2023 is 1% of each employee’s wages, up to a maximum of $132,900 for the year. Employees pay 60% of the contribution rate and employers pay 40% of the contribution rate. For example, if an employee made $1,000 in wages, the employee would pay $6 and the employer would pay $4 for this paycheck. Employers with fewer than 25 employees are not required to pay the employer portion of contributions.

See https://paidleave.oregon.gov/Documents/Paid-Leave-Oregon-Employer-Guidebook-EN-September-2022.pdf for more information.

To create a pay factor for this payroll tax, please follow these instructions:

- Backup your company data before making these changes.

- Go to Payroll/Configure/Tax Calculations and create a new Tax as follows. Click OK and Save Changes.

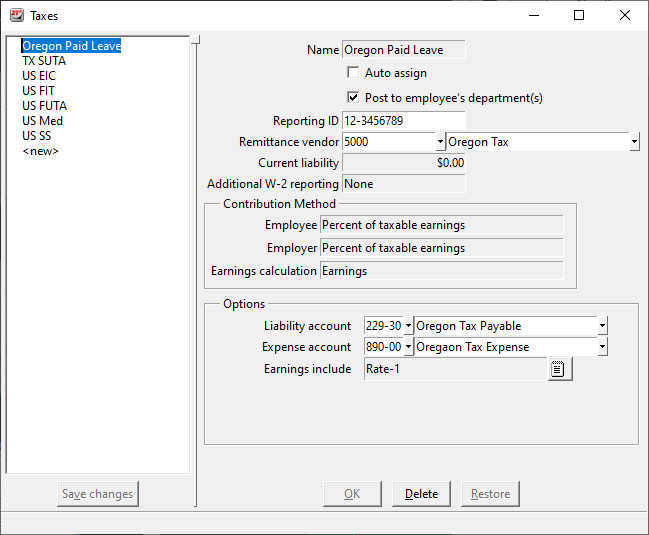

- Go to Payroll/Configure/Taxes and assign the tax to a Remittance Vendor, select relevant earnings, and assign Liability and Expense accounts similar to the following.

- Click OK and Save changes.

- Assign the Tax to your relevant employees.

- After posting your payroll, review the amounts in the Payroll/Print Taxes Activity report.