Configuring employees for 2020 or later W4s

The information below relates to changes made to the W-4 in 2020

Configuring employees for 2020 or later W4s

The IRS is encouraging, not requiring, employers to use the newly designed 2020 W-4 as they feel that the new form provides more transparency and accuracy. If you have employees that have not turned in 2020 or later W-4s, you can continue to use W-4 forms from 2019 and earlier. If you have some employees with 2019 or earlier W4s and some with 2020 or later W4s, that is fine. You can use the instructions below to configure your employees based on which W4 you have for each employee.

If you have questions about this information, please contact us before proceeding.

Please do the following before installing any Tax Updates or Software Upgrades:

- Make a backup of all of your companies.

- Make sure all pay periods are closed before installing.

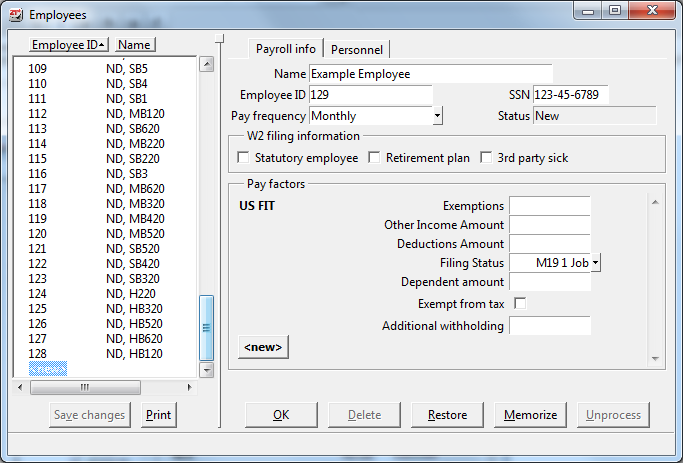

- Once you install a Tax Update configured for 2020, if you have not previously reconfigured your employees for 2020 W-4s, you will need to go to Payroll/Configure/Employees and reconfigure whichever employees you need to Calculate Payroll for in the future. In other words, you cannot run a payroll for any employee that has not been reconfigured. You do not need to reconfigure employees that you do not need to run payroll for.

- For tips on more efficient payroll configuration, see our Hot Topic: C21 Tips for Efficient Payroll

Please refer to the W-4 published by the IRS at the following address for detailed information about this form and as a reference:

https://www.irs.gov/forms-pubs/about-form-w-4

In Payroll/Configure/Employees, you will see the following Filing Statuses for US FIT :

Filing Status Code |

Filing Status |

M19 1 Job |

Married Filing Jointly 2019 W4 or Married Filing Jointly with 1 Job 2020 W4 |

S19 1 Job |

Single or Married Filing separately 2019 W4 or Single with 1 Job 2020 W4 |

H20 1 Job |

Head of Household 1 Job 2020 W4 |

MFJ20 2 Job |

Married Filing Jointly 2 Jobs 2020 W4 |

S20 2 Job |

Single or Married Filing Separately 2 Jobs 2020 W4 |

H20 2 Job |

Head of Household 2 Jobs 2020 W4 |

NRA |

Nonresident Alien 2019 W4 |

NRA2020 |

Nonresident Alient 2020 W4 |

Exemptions – If you are using 2019 or previous Form W-4s, leave the number of exemptions as they are. If you are using 2020 Form W-4, use the chart below to enter the correct number:

Filing Status |

Step 2 |

Number to enter |

Married Filing Jointly |

Step 2 NOT checked |

3 |

Single, Head of Household, Married Filing Separately |

Step 2 NOT checked |

2 |

All Filing Statuses |

Step 2 Checked |

0 |

Other Income Amount – Enter the amount in Step 4(a) of your 2020 W-4 Form.

Deductions Amount - Enter the amount in Step 4(b) of your 2020 W-4 Form.

Filing Status - Use the tables below to enter the correct status.

2019 or previous Form W-4:

Filing Status |

Status Code |

| Married Filing Jointly |

M19 1 Job |

Single, Married Filing Separately, or Head of Household |

S19 1 Job |

Nonresident Alien |

NRA |

2020 Form W-4 Step 2 NOT checked:

Filing Status |

Status Code |

| Married Filing Jointly |

M19 1 Job |

Single or Married Filing Separately |

S19 1 Job |

Head of Household |

H20 1 Job |

2020 Form W-4 Step 2 Checked:

Filing Status |

Status Code |

| Married Filing Jointly |

MFJ20 2 Job |

Single or Married Filing Separately |

S20 2 Job |

Head of Household |

H20 2 Job |

Nonresident Alien |

NRA2020 |

Dependent Amount – Enter the currency amount listed on 2020 Form W-4 in Step 3.

Exempt from Tax – Check this box if the employee is exempt from tax.

Additional Withholding – Enter the currency amount listed on the 2020 Form W-4 in Step 4(c). This is the additional amount to be withheld per pay period.

North Dakota SIT

Please be aware of the following changes to North Dakota statuses and allowances. You will need to reconfigure your employees in Payroll/Configure/Employees before you will be able to Calculate Payroll.

Form |

Factor |

Change |

2019 Form W-4 |

Head of Household |

Select Filing Status 19 Head of Household |

2020 Form W-4 |

Head of Household |

Select Filing Status 20 Head of Household |

2020 Form W-4 |

Allowances |

Enter Zero Allowances |

Click here to download this Payroll Tax Update.