Information for COVID-19 Changes

Check your COVIDSICK and COVIDFAMILY Income Factors

After you have set up your new COVIDSICK and/or COVIDFAMILY Income Factors and included them in a Payroll, you can check to see if they have been applied correctly by taking the following steps:

- Go to Payroll/Print/Payroll Register.

- Check “Show employer contribution?”

- Select any other parameters desired.

- Preview the report and look at the line that says US SS (Employer).

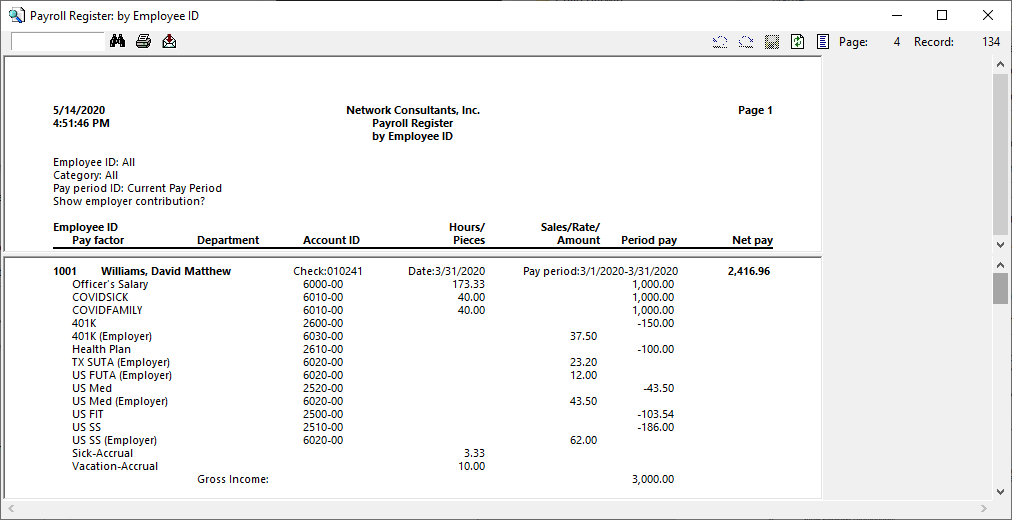

- If a COVIDSICK or COVIDFAMILY Income Factor was calculated, there should not be a positive amount listed in the US SS (Employer) line unless you inclued other types of income. If other types of income were included, check that the amount is 6.2% of other income factors only as shown below.

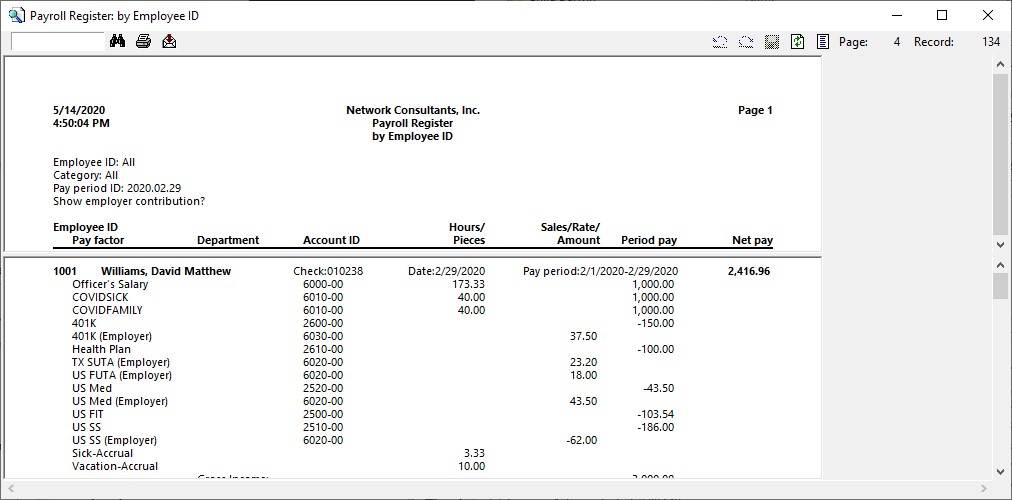

- If there is a negative amount listed in the US SS (Employer) line, the system is compensating for a past payroll that included a Covid related sick pay that was changed to COVIDSICK or COVIDFAMILY but did not exclude the US SS Employer portion previously.

Please note that this type of pay is only eligible for the US SS Employer exclusion from April 1, 2020 - December 31, 2020 until further notice. US Med should still be calculated but may refunded at a later date. Please check with your accountant or the IRS for more information.

If you have any questions or require assistance, please contact us.